Weekly technical analysis for 23 – 27.06

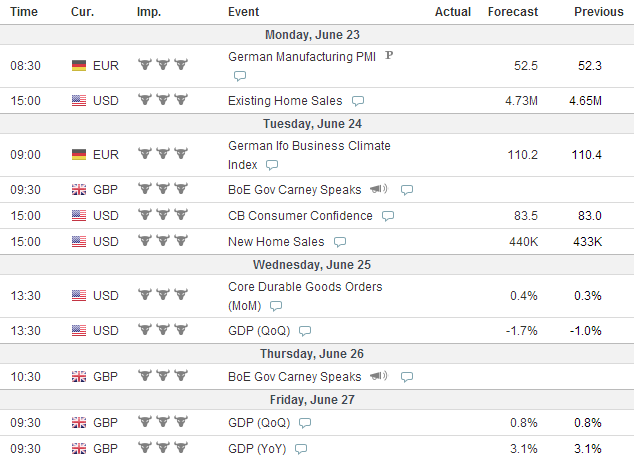

IMPORTANT ECONOMIC DATA DURING THE WEEK (GMT)

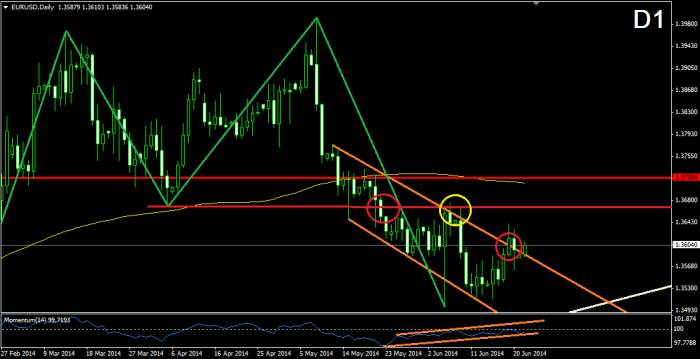

EURUSD:

The price did a bullish break through the upper level of the orange bearish corridor from May 12. As you probably remember, the price was moving after a double top formation (green) and was expected to reach the white bullish line, which connects the bottoms from July 2012 and July 2013 on the MN chart. The bullish break through the bearish corridor implies that the price might reach as a resistance the already broken neck line of the green double top formation. Furthermore, there is a bullish divergence between the bearish corridor and the momentum indicator, which shows a bullish corridor. For this reason, we believe that this might be the end of the bearish movement and the price might reach new levels like 1.37184.

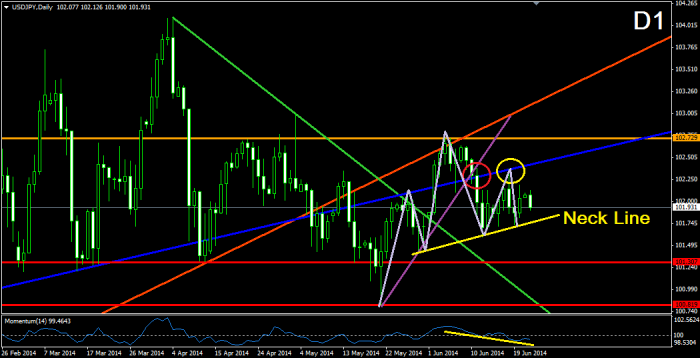

USDJPY:

The bearish break of the price through the small purple bullish trend line has moved the price in such way, so a head and shoulders formation (gray) is about to get confirmed. At the same time, there is a clear bearish divergence between the last two bottoms of the chard and the momentum indicator, which also speaks of an upcoming bearish activity. Furthermore, after the break through the purple bullish trend line, the price returned and bounced from the already broken blue bullish trend line as from a support. For this reason, we believe that the price might start a new bearish movement, which could eventually break through the support at 101.307 and has the potential to reach the next crucial support at 100.819

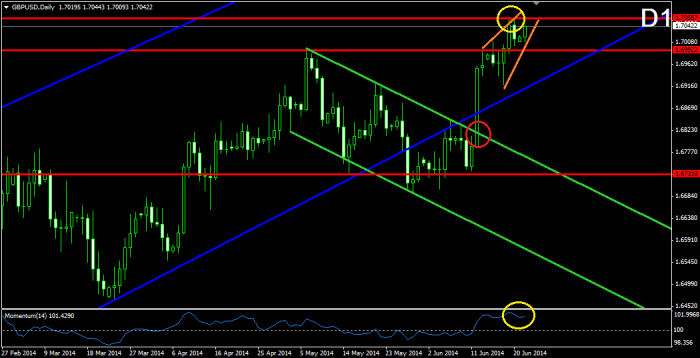

GBPUSD:

After the bullish break through the green bullish corridor, the price also broke through the resistance at 1.69922, which indicates the previous top of the price from the same rank, and then it stopped in the 1.70587 level, which indicates the 5-years high of the price. As you see, the latest bullish movement of the price (orange) resembles a bit a rising wedge formation, which as we all know, has the potential to send the price downwards. At the same time, the momentum indicator is located pretty high, which implies that a drop might be about to occur. Maybe the price would not manage to break the 5-years high at 1.70587 after all.

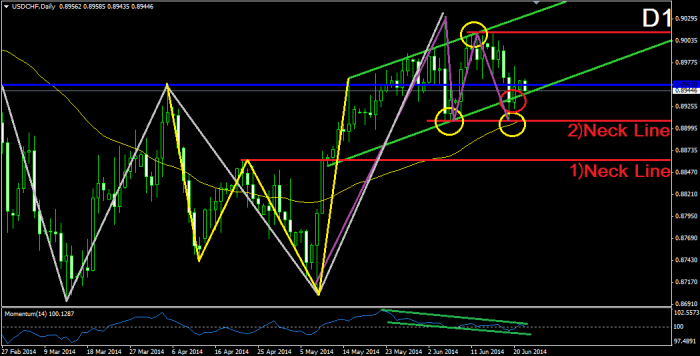

USDCHF:

The first things we notice on the D1 chart of the Swissy are: the potential double top formation (purple) and the bearish divergence between the chart of the price and the momentum indicator in the past 30 days. As we all know, these two conditions have bearish potential and could send the price downwards. Another bearish sign is the break of the price through the lower level of the green bullish corridor, which supports the bearish scenario. These conditions could drop the price at least to the support, which indicates the neck line of the small and already completed double bottom formation (yellow). At the same time, this would confirm the purple double top formation and could push the price even further. On the other hand, the price might continue its bullish increase and could reach at least the resistance, which indicates the second top of the purple double top formation and even the upper level of the green bullish corridor.

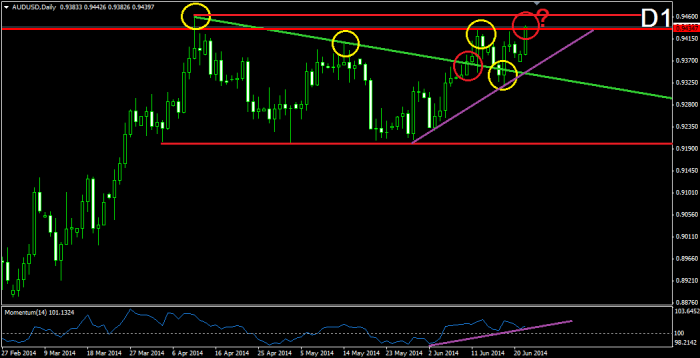

AUDUSD:

After the ice price broke through the green bearish trend from April 10, we saw the price returning to the level and testing it as a support. The followed bullish bounce brought the price to the resistance at 0.94347, which indicates the high point of the price after the break through the green bearish trend line. The break through the 0.943476 resistance gives us now a clear signal for a change in the bearish trend (green). The overall bullish movement follows a bullish trend line (purple), which set its beginning on May 29. So, after the break, the price might find resistance in the next red level, which indicates the 5-months high of the price from April ten, and to return to the purple bullish trend line.

Leave a comment