Weekly technical analysis for 26 – 30.05

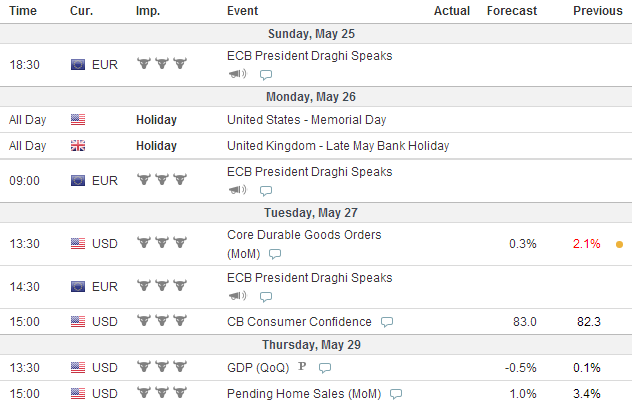

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

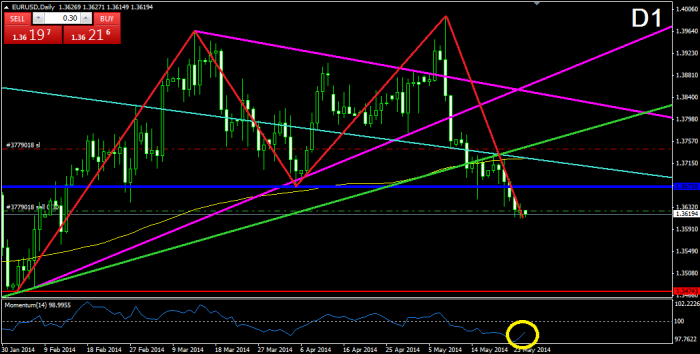

EURUSD:

After breaking through the green bullish trend line from July 2012, the price decreased even more and it also broke through the blue 1.36710 neck line of the red double top formation on D1, which is a confirmation of the figure. For this reason, it is likely to expect the price to drop to the support at 1.34743 in the near future. Currently, the price is signing a slight slowdown of its bearish movement. At the same time, the Momentum Indicator signalizes for a decrease in the bearish activity. For this reason, we might see a bullish correction, which could meet the price with the blue level at 1.36710, or with the already broken turquoise 6-years bearish trend line.

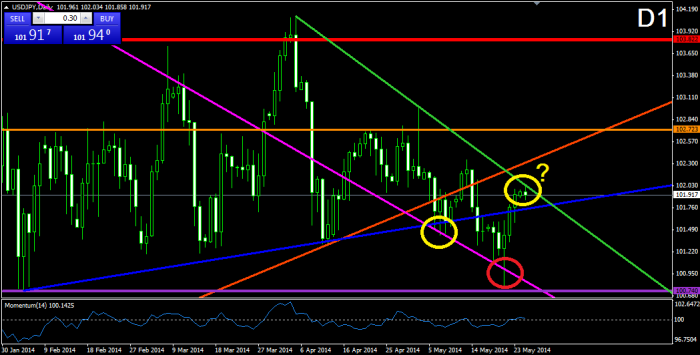

USDJPY:

After breaking through the blue bullish trend line from February, the price decreased twice to the already broken purple bearish trend line from December 2013 and tested it as a support, where the second time, the price even broke the purple bearish line and it reached the purple support at 100.740. The followed bullish bounce during the last week increased the price and created a top, which formed the green bearish trend line from April 04. Currently, the price is testing this trend as a resistance and a bearish bounce is expected. For this reason, we believe that the price would decrease again to the 100.740 support and this time it could even break it. The momentum indicator is around the 100-level line and it could cross it again in bearish direction at any time.

GBPUSD:

After the bounce from the lower level of the blue bullish corridor (W1), the price increased and created a top, which is actually lower than the previous one. This allows us to draw a bearish line between the two tops, which could be considered as a potential resistance. If the price breaks through the white bearish line, we could expect another increase to 1.69700, which could even push the price even higher – to the upper level of the blue bearish corridor for example. At the same time, the momentum indicator is on the 100-level line and it is testing it as a resistance now. A bullish cross of the 100-level line would support the bullish scenario. If the price breaks eventually through the lower level of the blue corridor, we might see the beginning of a new drop, where every previous bottom would be considered as a potential support.

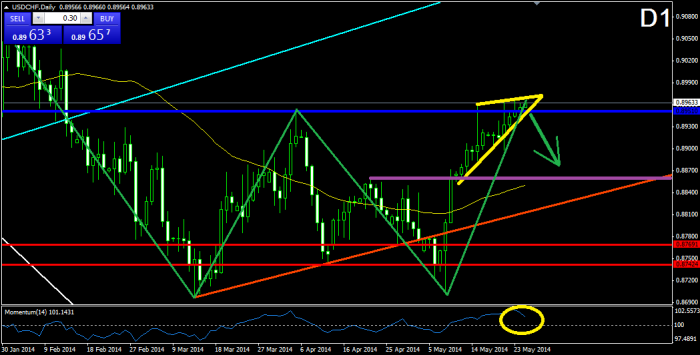

USDCHF:

During its last increase, the Swissy has decreased the intensity of its bullish movement recently and the price has formed a rising wedge formation, which crossed the neck line of the big double bottom formation while forming. The interruption of the blue neck line at 0.89510 speaks of a overall bullish increase, but the rising wedge formation implies that a correction of the bullish activity might occur. As we know, the rising wedge has the potential to push the price in bearish direction to a distance equal to the size of the formation. For this reason, we believe that the price might drop to the already broken purple neck line of the smaller double bottom formation, and to test it as a support before any increase. The momentum indicator has already changed its direction.

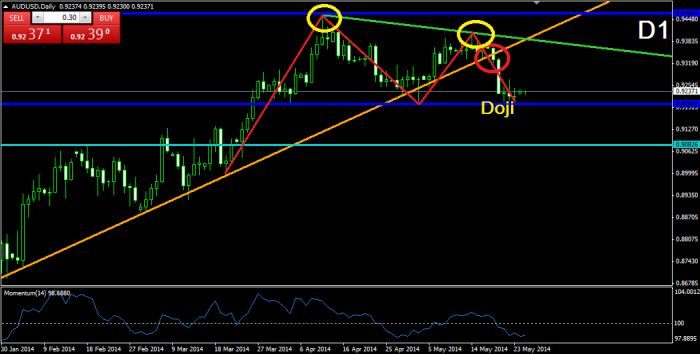

AUDUSD:

After breaking in bearish direction through the orange bullish trend line from January, the price decreased to its previous bottom at 0.92001, which is shown as a blue support on the chart. It is obvious that the price is finding support there, which infers that a new bullish bounce might occur. Furthermore, the price has closed a Doji candle, which supports the eventual change of the direction. Moreover, after it reached its lowest levels, the momentum indicator is currently switching its direction. For this reason we believe that the double top formation will wait for a while and the price would eventually increase to the green bearish line, which connects the last two tops of the price.

Leave a comment