Weekly technical analysis for 12 – 16.05

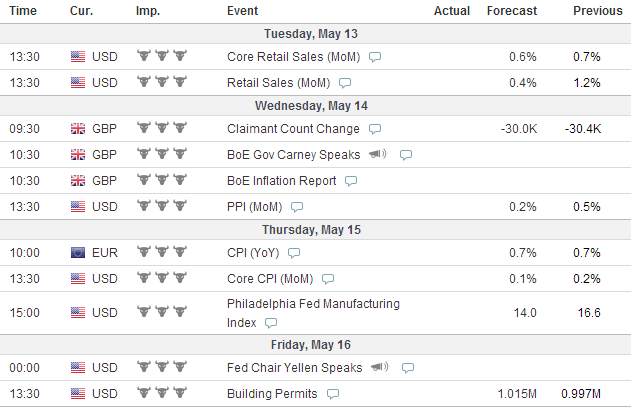

IMPORTANT ECONOMIC EVENTS DURING THE WEEK (GMT)

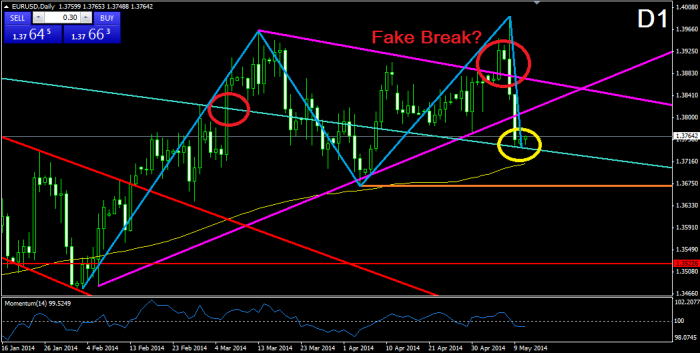

EURUSD:

After breaking through the upper level of the purple triangle, the price did a big rapid drop to the already broken 6-year bearish trend line (turquoise). Currently, it looks like the price is being supported in this trend line, because something like a bounce is being formed. For this reason, we believe that if the price is going to increase, it would first meet the already broken sides of the triangle as resistances. If the price breaks through the turquoise bearish trend line, we would probably see an interaction with Simple Moving Average 150 and the orange support, which indicates the previous bottom of the price and the neck line of a head and shoulders formation (blue). If this happens, the first break through the upper level of the purple triangle would appear to be fake.

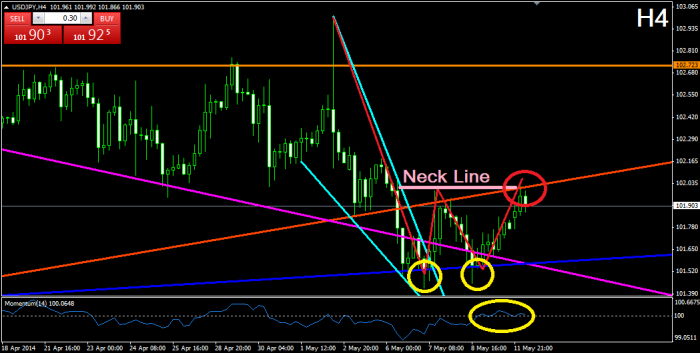

USDJPY:

After breaking in a falling wedge formation through the orange bullish trend line from March 2013, the price found support in the blue bullish trend line from the beginning of February, it broke in bullish direction through the falling wedge formation and it formed a double bottom formation. The price bounced in bullish direction afterwards and the double bottom formation got confirmed. At the same time, the Momentum Indicator crossed the 100-level line in bullish direction. With the cross of the neck line, it looks like the price is testing the already broken orange bullish trend line as a resistance. Having in mind that the double bottom formation is already confirmed and supported by the signals of the momentum indicator, we assume that the price would probably break through the orange line again and would continue its bullish movement.

GBPUSD:

The Cable did a surprising bullish break through the upper level of the rising wedge formation, which created the impression that the price would probably directly meet the upper level of the blue bullish corridor from November 2013. Suddenly, the price decreased as a result of economic information and the turquoise bullish trend line was formed. As you see, there is a bearish divergence between the chart and the momentum indicator, which warned us for the bearish decrease in advance. Now it looks like the price is being supported by this line and we might see a bullish bounce. If the price increases, it would first meet the sides of the already broken rising wedge as resistances. If the price breaks through the turquoise bullish trend line, we would eventually see a decrease to the lower level of the blue bullish corridor.

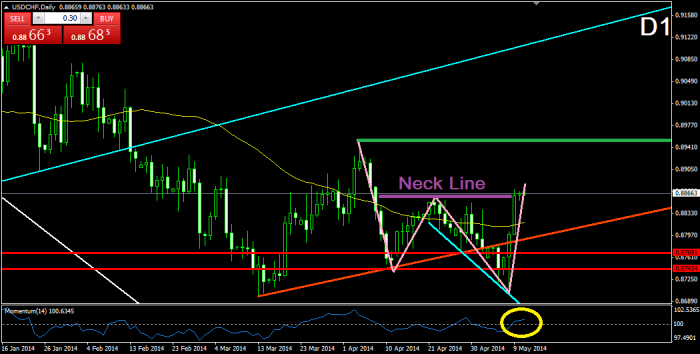

USDCHF:

The price has just confirmed a double bottom formation on the D1 chart. After its last bounce from the turquoise bearish line, the price increased in bullish direction ad crossed the neck line of the formation. At the same time, the momentum indicator has crossed the 100-level line in bullish direction. For this reason, we expect an increase of the price at least to the green resistance, which indicates the previous top of the price, and which is also the neck line of another, bigger double bottom formation. If this neck line gets broken, we would be able to look for more bullish pips from this pair.

AUDUSD:

After correcting to the orange bullish trend line from the beginning of January, the price created a Doji candle (green circle) and broke through the upper level of the wedge, which the price was correcting in. At the same time, the momentum indicator also increased in bullish direction through the 100-level line. Currently, the price is still increasing in bullish direction and it is expected to increase at least to the green resistance, which indicates the previous top of the price around 0.94530. If this happens, we should be careful for a break or a bounce, which would determine the future movement of the price of the Aussie.

Leave a comment